“A bank is a place that will lend you money, if you can prove that you don’t need it.”

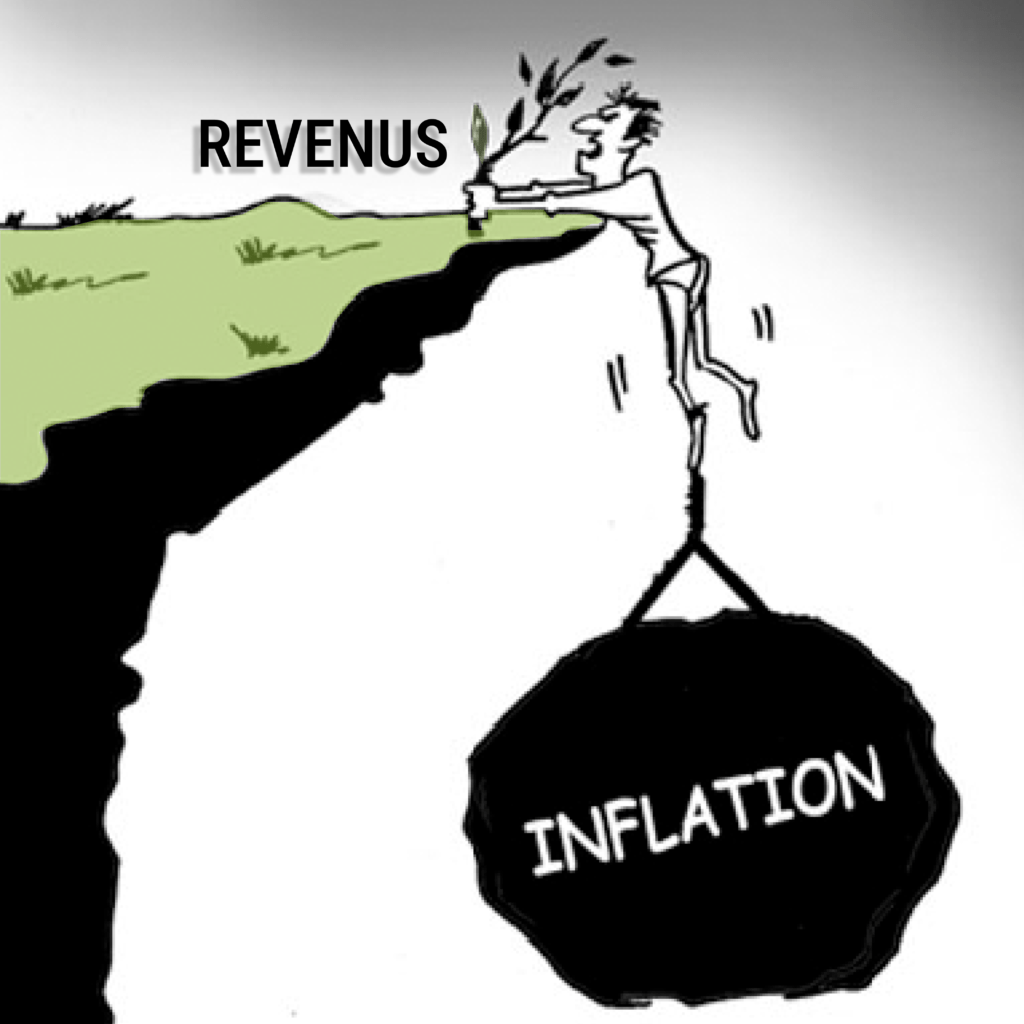

Inflation is a measure of the increase in prices – or put differently, a measure of your money becoming worth less. So, you may still have the same amount of money on your account, or maybe even more: But the goods and products you can purchase with the money are less, your assets have lost some of the purchasing power.

The above example only takes into consideration that you hold all your wealth in cash. That is not the case for most people, but then the question arises: Which asset classes are best to hold during times of (higher) inflation?

Before going any further, we need to establish a few basic notions:

A physical asset is the best way to preserve wealth. This is our fundamental thought and generally adopted conviction. After all, a painting will always be a painting just like a 3.5-room apartment will always be a 3.5-room apartment.

However,… The above observation is only relative. While it is true that inflation means that your money loses purchasing power, it actually applies to all financial assets – but physical assets lose less. So, let us look at these real assets, but before that we should look at the worst places to stock your wealth in times of inflation.

Stay away from Bonds and Cash

The old proverb that “cash is king” only holds true in times of stable and controlled inflation. When the savings you have stored in the account are held in cash, we only need to look very few months back to observe the impact of negative interest rates to see the same effect as inflation: Your money becomes worth less by doing nothing!

By keeping your wealth in cash, you get the full and direct (negative) impact of the inflation head on.

Bonds is a common asset class to protect not only against negative interest rates and can at first glance look attractive when observing the yields in current times of increasing rates. But to obtain a positive return on bond investments, investors are usually obliged to buy bonds with maturity of 10 years or more.

But, when you look at a bond with higher maturity, you also expose yourself to higher uncertainty towards the interest rate. And when interest rates go up, the bond will actually lose value, and even more so for the longer-term bonds.

Best assets are the Real Assets (especially in inflationary periods)

As mentioned in the beginning, investment in a tangible asset is significantly better than bonds or cash. This is, however, provided we are talking about the same definition of what is a “real asset”. By defining a real asset at tangible, we infer that there is a physical subject which can be touched (real estate airport parking, ships or commodities). If this is the case, we also infer those shares belong to financial assets – like bonds and cash on accounts.

So how do shares fare in inflationary times?

Shares are basically smaller parts of a company, and by purchasing a share you also become part owner of said company. If the company does good, it is equally good for the shares. Inflation is not directly bad, but neither is it directly good for the companies. When going through periods of inflation, the cost of production goes up through raw materials or salaries, which is clearly not good for the companies.

However, many companies can raise their prices (inflation!!!) as costs rise, so we could also argue this is good for the companies. It may turn out that a company is neither better nor worse off in periods of inflation. History does show that equities lose value in times of inflation. The reasons are plenty, but for one, in order to curb inflation, the central banks raise interest rates, which in turn puts a brake on economic activity. When interest rates reach a certain level, bonds suddenly look attractive and cash shifts (from equities) to bonds.

Real Estate investing

No matter how much we try, we cannot escape the fact that real estate is a real (tangible) asset. Just have a look at your own home which in terms of utility remains with the same usage value 1:1. As mentioned initially, a 3.5-room apartment with a view on Lac Leman will remain a 3.5-room apartment with a view on Lac Leman.

When looking back in History, real estate has shown itself as a stable asset in times of inflation. The stability of returns is attractive in times where the (stock)markets are insecure and often showing no clear signs of direction.

Furthermore, in times where interest rates go up, more people will choose to rent instead of buying a home. Therefore, investors who have accumulated real estate to provide multifamily housing will see the demand increase, providing stability and further insurance.

There will always be a demand for housing and real estate no matter what. Mark Twain was quoted to say “buy land, they aren’t making it anymore” – people will always need somewhere to live. It only seems fair to assume that when prices are rising, property would be a favorable choice to invest your money. The correlation between consumer price index and rental prices is obvious, and as rental income increase, so does the value of the property.

This fact makes even more sense when you consider, for example, that in Switzerland, the continuous rise in real estate prices and the requirements imposed by banks in terms of financing limit access to property for a large part of the Swiss population. Significant resources are required to overcome the various obstacles.

If we add to this the fact that buying a property has become more expensive than renting it, following the rise in mortgage rates, the addition of extra charges and the surge in construction prices (read our article on the subject), it is easy to understand why investment in real estate equity is so popular.

Indeed, the unique model, based on profitability, that SIPA Crowd Immo proposes, constitutes an innovative, diversifying and adaptable asset. The proof is that you receive attractive high returns (from the rental income of our properties, i.e. between 5 % and 7 % net per year) by investing in our projects ( from CHF 49’000). Thus, it seems relevant to be interested in investment alternatives in order to adapt to the new economic and financial challenges we have to face.

Search