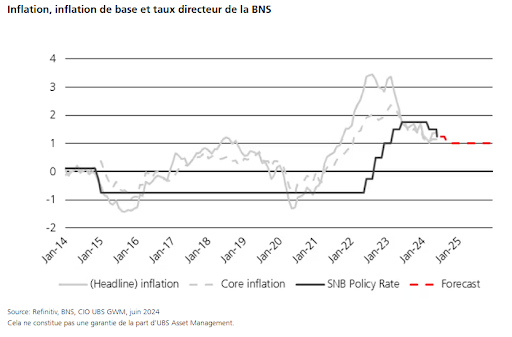

The Swiss real estate market in 2025, marked by the emergence of the lowering the key interest rate to 0.5%. decided by the SNB in December 2024. This strategic measure could well redefine the dynamics of the sector, influencing buyers, investors and developers alike.

Focus on the business model

From an economic point of view, we’re talking about a significant impact on the real estate financing. Indeed, the real estate market could continue to see demand evolve. Particularly in city centers.

Lower interest rates are reshuffling the cards in the market. cost of financing real estate and this favors private investors, buyers and sellers.

For buyers, low interest rates mean lower monthly expenses.

For sellers, the increase in demand, aided by favourable market conditions mortgages granted, facilitates the sale of real estate.

Another fact is that the return/cost ratio is better for investors on long-term financing.

This means that individual needs are more likely to be met thanks to more flexible financing models, since rental and multi-family housing in their financing.

As a result, investors are looking for stable returns as the real estate investments are not about to weaken.

Demographic trends

As we said, the Swiss real estate market is changing.

Deux raisons justifient ce fait :

- rising immigration

- an increase in household demand for housing, particularly in urban areas.

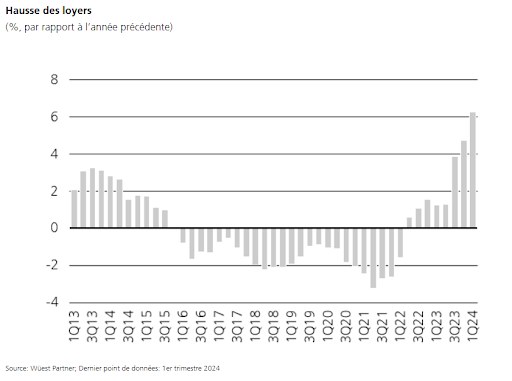

While construction activity in 2024 fell short of requirements, we are once again witnessing an increase in demand. housing shortage. As a result, rents are rising.

In addition, the aging of the Swiss population is accentuating the demand for housing adapted to senior citizens.

New construction: innovations to meet the housing shortage

Construction activity in Switzerland is gradually picking up, and could regain momentum by 2025.

Projections indicate a 5.7% increase in construction volume next year, driven by increased investment in new projects and the gradual reduction of existing obstacles.

In urban centers, priority is given to compact, optimized housing to meet fast-growing demand.

However, investors and promoters must both accelerate project development and ensure their economic viability in order to maintain their competitiveness over the long term.

Strong demand for housing, particularly in the city, remains a key driver of the market.

Participative shareholding is above all a response to the human aspect of investment.

Investment alternatives such as shareholder participation are part of the Swiss landscape.

The movement is taking shape and growing with SIPA crowd immo, thanks to the many monthly events organized across Switzerland.

The exchanges are constructive, the meetings enriching, and recent feedback shows that SIPA places the human aspect at the heart of real estate investment.

An essential criterion on the real estate market 2025, which is the primary objective of investors.

SIPA crowd immo has a bright future ahead of it as long as innovation serves people.

Search