The Swiss property market is closely linked to interest rates and inflation.

In 2023, this will remain a constant, and the effects will be felt in rising rents, due to an increase in the reference rate.

However, the Swiss property market is faring better than its foreign counterparts, with house prices expected to fall by less than 5% a year from 2024 (source: Crédit Suisse).

As a result, new questions are being asked about the real estate sector.

Artificial intelligence is raising new questions. Chat GPT and metaverse are fuelling the debate. Although most users are still in the early stages of experimentation, it is worth considering the impact and value of this technology for the Swiss property market.

The rise of chatbots

Chat GPT and Google’s artificial intelligence tool, Bard, are opening up new horizons in the real estate world.

The latter generate texts in a matter of seconds and formulate answers to complex questions (on the face of it, in the case of the latter).

Because, yes, the purpose of these tools does excite us when we question them on more specific issues, such as :

- Create effective property advertisements.

- Draw up plans to facilitate construction and property planning.

- Analyze the Swiss property market to identify the best opportunities.

- Estimate property prices and complete property valuations.

Today, AI saves time. However, the results are sometimes wrong, so you need to keep a close eye on your answers.

An early revolution for the Swiss property market?

Chat GPT and Bard are undeniably fast.

It’s easy to interact in natural language to ask questions or submit instructions.

However, the underlying difficulty remains the risk of wrong answers.

How can you trust an AI that does not source its results?

Solutions are being developed, but at present it is difficult to identify the data processing.

The quality of the results depends on this component, and it will be important for the supervisory authorities to analyse these advances, which are sometimes synonymous with abuse.

What’s more, chatbots are evolving at lightning speed and simplifying the automation of processes.

A revolution is underway!

Real estate in the digital age: Metaverse!

Investing in virtual land. Who would have thought?

Certainly, property developers, whose buying process resembles that of buying a plot of land in the real world.

The location of a property in the metaverse determines its price, which can rise very quickly.

Users interact as avatars and pay in cryptocurrencies.

The properties purchased are guaranteed by NFTs (Non-Fungible Tokens). Digital certificates are issued and authenticate the ownership of virtual assets such as a building or a plot of land on a blockchain, associated with the decentralised digital land register.

The risks of the virtual property market

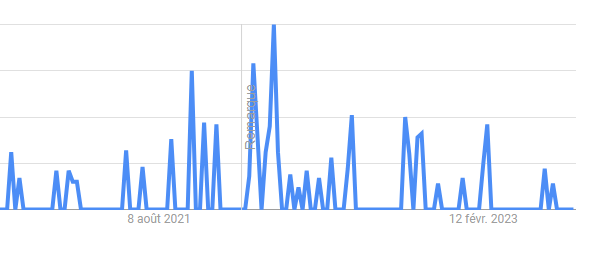

According to Google Trends, it seems that the metaverse has not won over its audience.

In fact, two components come into play:

- the time spent by the public on the metaverse.

- the benefit/risk ratio.

The high volatility of prices, the use of cryptocurrencies and the uncertainties of virtual platforms as to their direction, as well as legal uncertainties, all act as brakes on expansion.

The technological transition is costly and often slow. For the time being, metavers are still in their infancy.

Players in the real estate sector will need to be cautious and open-minded if they are to fully seize the opportunities and meet the challenges that these new technologies bring. A balanced and considered approach will be needed to make the most of these innovations and ensure that the Swiss real estate market continues to develop positively in the years ahead.

Search