Le swiss real estate aims to be carbon neutral (zero greenhouse gas emissions) by 2050.

For example, the Swiss Federal Office of Energy (SFOE) provides support to property owners with the help of the Confederation, cantons and municipalities in the energy transition.

At present, the energy effort is considered to be considerable, given the high demands placed on fleet audits and renovation planning.

Net zero emissions fromParis Agreement requires new, structured approaches to reducing energy consumption. In addition, the emissions generated by the building, transport and industry sectors need to be reduced and offset by natural and artificial reservoirs, known as ‘carbon sinks’.

In 2022, the FOEN indicated that Switzerland emitted 3.5 million tonnes less CO2 than the previous year, and had declined, particularly in the construction sector.

These encouraging results are encouraging owners to respect ESG criteria and getting rid of old buildings dating from the 1960s to the 1990s, in order to prioritise good energy ratings.

Of course, the stock of buildings in Switzerland in need of energy renovation continues to rise, but this also increases the acquisition value for investors.

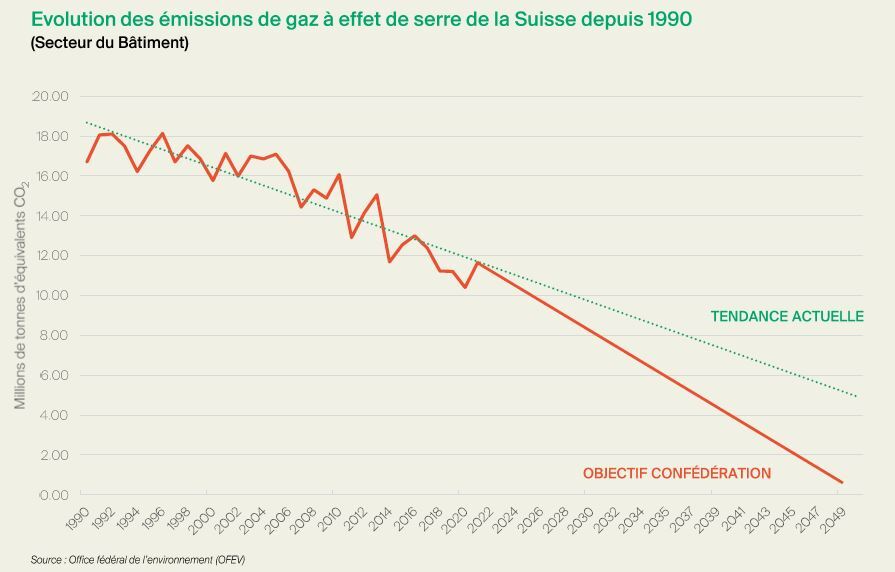

Greenhouse gas emissions in Switzerland since 1990

The Swiss building stock consumes 40% of the final energy delivered to the consumer, 70% of which is attributable to fossil fuel heating systems..

The Confederation’s target of zero CO2 emissions by 2050 means that all the energy needed to heat and cool homes, businesses, public buildings and industry must come entirely from renewable energy sources and be CO2 neutral.

Source: Federal Office for the Environment (FOEN)

The trend curve for the building sector shows that the efforts undertaken require additional attention if we are to get closer to the Confederation’s targets.

To achieve this, the The Energy Master Plan (EMP) was adopted by the Council of State on 2 December 2020. for :

- reduce energy consumption.

- optimising the supply of local energy resources.

This measure will help to accelerate the energy transition of the building stock, both in terms of quantity and quality, and reduce the number of new buildings. energy consumption per m² of living space.

In addition, the law provides for intermediate targets between now and 2050, for homeowners who opt for wood-fired heating, heat pumps or investment in the insulation of their homes, with a heat expenditure index (HEI).

source: Ge.ch / Cantonal Office of Energy (OCEN)

Impact on property values and profitability

For building owners, heating costs are a good investment, as investors are willing to pay more for more sustainable buildings.

A building fitted with a heat pump certainly offers a lower return than one heated with fossil fuels. What’s more, investors will pay more for fossil fuel heating than for sustainable heating.

This is explained by the importance of the ESG taxonomy for which investors accept lower, but more sustainable, initial returns.

Secondly, it’s easier to approach a CO2 emission-free investment property financing offer. Fossil energy sources can represent a risk of irrecoverable assets and heavy expenditure.

Lastly, the risk is lower for the leasing of long-lived buildings, as the uncertainties associated with changes in regulations have less of an impact on cash flows.

A historic agreement for energy-efficient renovation of buildings

On 21 March 2024, the death knell will sound for a historic agreement, unanimously approved by the Grand Council, on the energy-efficient renovation of buildings.

This agreement provides for :

- maintain the cantonal heat expenditure measurement system (IDC).

- split CHF 500 million of cantonal subsidies between private owners (70%) and municipalities and public institutions (30%).

- the addition of CHF 50 million in loans and, in the longer term, federal subsidies.

- offer bridging loans and guarantees to homeowners who are not eligible for bank mortgages and are unable to finance the renovation of their buildings.

- no additional rent increases due to subsidies granted under the Energy Act.

- grant owners of villas and small buildings with fewer than five dwellings a 3-year extension.

Achieving zero greenhouse gas emissions in the Swiss real estate is fundamental to the progress of our sector.

Strengthening financial measures, such as subsidies and bridging loans, is essential to encourage owners to invest in energy-efficient renovation of their buildings and raise public awareness of the energy transition.

However, we recommend that you keep an eye on trends, as there is strong demand for investment property in Switzerland:

- low bond yields and high risk.

- abundance of liquidity according to the Swiss cantons.

- lack of reliable investment alternatives.

SIPA Crowd Immo has never been so present on the participative investment scene for institutional and private investors, despite the varying appeal of real estate in different Swiss cantons.

It has to be said that the reasons vary:

- access to infrastructure,

- economic dynamism, job growth,

- demand for housing.

In Geneva, for example, gross yields are low but demand is strong, while rates in Neufchâtel and the Jura are higher.

It is important to remember that investors’ demands are due to strong regional disparities and high vacancy rates.

—

SIPA Crowd Immo participative shareholding concept is a perfect response to both these factors.

Want to find out more? Sign up to our priority list to be the first to know about the latest news.

Search