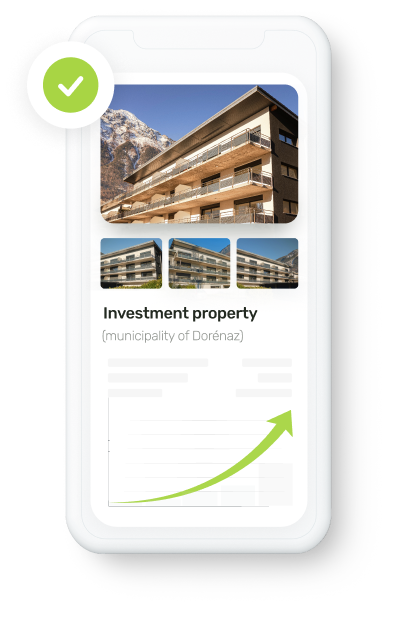

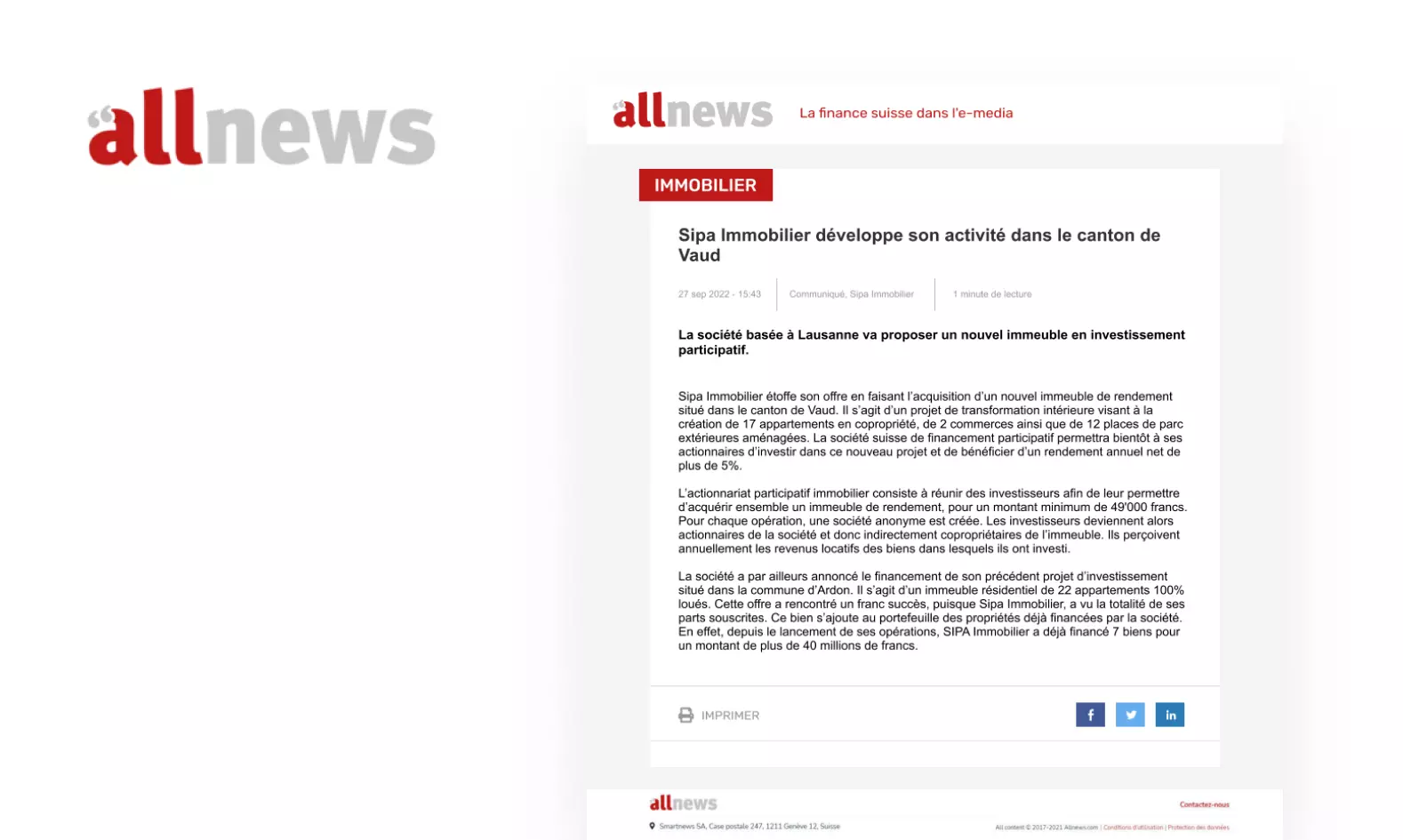

INVESTING IN PROPERTY

To generate between 4% and 7% net annual yield

I want to be on the priority list

One of our staff will be in touch shortly to provide you with exclusive information about our new investment project.